One of the questions I see all the time from potential pharmacy students is: is it worth it? Are pharmacy school education and its corresponding debt load, worth the time that I will invest into it? With an average pharmacy graduate carrying around $123,063, this isn’t a question that deserves a quick answer. Combine the average student loan debt with the reality of missed wages, and the opportunity cost of 4-6 years depending on whether you pursue a residency, I figured I would look around and see if there were good answers to this question.

Luckily for us, there are plenty of studies that looked at the question of return on investment for a pharmacy education. I’ll share a couple of them with you today.

I came across a pair of interesting articles written in the American Journal of Pharmaceutical Education (AJPE). One is titled “Pharmacy Student Debt and Return on Investment of a Pharmacy Education,” and is authored by Jeff Cain, EdD, Tom Campbell, PharmD, Heather Brennan Congdon, PharmD, Kim Hancock, PhD, Megan Kaun, PharmD, Paul R. Lockman, PhD, and R.Lee Evans, PharmD. It was published in the February 2014 edition of the AJPE. The other paper is titled “Break-Even Income Analysis of Pharmacy Graduates compared to High School and College Graduates” and was written by Marie A. Chisholm-burns, PharmD,MPH, MBA, Justin Gatwood, PhD, MPH, Christina A. Spivey, PhD, and Susan E. Dicket, BA. This paper was published in the April 2016 edition of AJPE.

Lets see how these studies can help us to answer the return on investment question!

Q: What was the first study about?

A: The first study “Pharmacy Student Debt and Return on Investment of a Pharmacy Education” takes a look at student indebtedness and compares it with income. This particular study was most helpful as a gauge for keeping an eye on the trends in debts and how pharmacist’s salaries are (or aren’t) keeping pace with the quickly increasing price of education. This study compared pharmacy student debt/income with that of physicians and dentists.

Q: How did they look at student debt and return on investment?

A: They created a metric called the “Salary:Indebtedness Index (SII)” to measure for potential return on investment. “The SII is calculated by dividing the average salary for a year by the respective average indebtedness of the student.” This metric basically determines if changes in tuition are keeping pace with changes with salaries. Whereas an SII close to 1.0 indicates that salaries are keeping pace with debt accrued during pursuit of said salary.

Q: Makes sense, so what did they find using the SII to look at return on investment?

A: Summarizing their work (squeezing six pages into a couple of paragraphs)– the SII index has generally stayed within 1.0 for the time period from 2002-2011. However, in 2011 there was a significant drop in average pharmacist salary (-$3,064 below the predicted value [95% confidence limit]), thus the SII for pharmacy dropped below the 1.0 mark for the first time since 2002. They worried that this was a harbinger of a trend toward decreasing return on investment for pharmacy students.

Along with the drop in salary in 2011, there was a decrease in positions in 2012 when compared to 2011. The authors also provide a handy table that shows what repayment could look like under different interests rates. What is scary is the fact that a pharmacist paying on the extended repayment plan @ 11% could end up paying in excess of $360,000.

Matter of fact here:

| Repayment Plan and Interest Rate | Months in Repayment | Monthly Payment, ($) | Total Interest Payment ($) | Total Loan Payment ($) |

| Standard @ 5% | 120 | 1,305.27 | 33,569.89 | 156,632.89 |

| Standard @ 8% | 120 | 1493.09 | 56,108.25 | 179,171.25 |

| Standard @ 11% | 120 | 1695.19 | 80,360.16 | 203,423.16 |

| Extended at 5% | 300 | 719.41 | 92,761.21 | 215,824.21 |

| Extended at 8% | 300 | 949.82 | 161,883.06 | 284,946.06 |

| Extended at 11% | 300 | 1206.16 | 238,783.97 | 361,846.97 |

Q: Well, that’s interesting. Did the SII “dip” continue?

A: Great question. I haven’t seen a follow-up study but I did a rough calculation of SII myself with more recent numbers.

Using numbers I pulled from different sources I calculated an updated SII. I pulled average/mean income for pharmacists from the May 2015 Bureau of Labor and Statistics report (http://www.bls.gov/oes/current/oes291051.htm) = $119,270. According to the American Association of Colleges of Pharmacy’s 2014 Graduating Student National Summary Report, the average student loan debt for PharmD graduates was $144,718.

This gives us an SI = 0.82. This is of course below the return on investment (ROI) SII that the authors calculated in 2012. They calculated a ROI SII of 0.98. Although my SII is not quite as thoroughly derived, I do believe my sources are legitimate although there is a 1-year difference between the income and debt figures. This does point to a trend toward declining return on investment for pharmacy students. This trend might continue if student loan debt continues to balloon like it has for pharmacy students and salaries don’t experience a similar rise.

Q: Ok, thanks. So tell me about the other study you looked at for figuring out the return on investment for a pharmacy career?

A: The “Break-Even Income Analysis of Pharmacy Graduates Compared to High School and College Graduates” was a bit more straightforward. Also more encouraging after the downer that was first study.

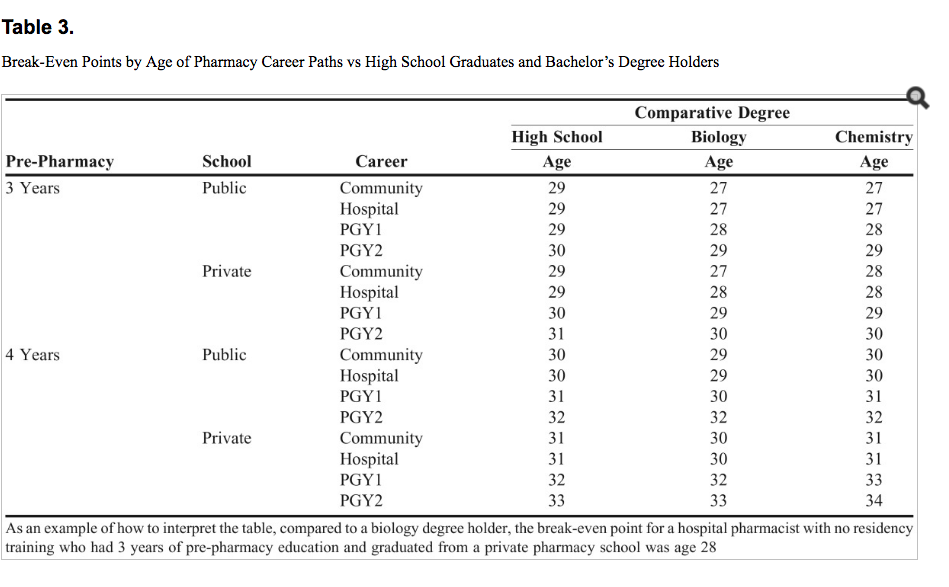

The break-even study basically looked at incomes for different career paths: “(1) immediate employment after high school, (2) employment after a bachelor’s degree (with a chemistry or biology degree), (3) employment as a pharmacist in a hospital or community pharmacy setting after at least three years of undergraduate study and obtaining a PharmD; and (4) employment as a hospital pharmacist following at least three years of undergraduate study, obtaining a PharmD, and completing one (PGY1) or two (PGY1 and PGY2) years of residency training.”

The possible career paths for pharmacy school were broken into (1) public pharmacy school (completing undergraduate coursework in 3 years), (2) private pharmacy school (completing undergraduate coursework in 3 years), (3) public pharmacy school (completing undergraduate coursework in 4 years), and (4) private pharmacy (completing undergraduate coursework in 4 years).

They then used Markov modeling (Google it) and break-even analysis to compare net career earnings from the age of 18 to 35.

Q: Got it, so they basically computer modeled a bunch of possible educational and career paths and compared them right? What they find?

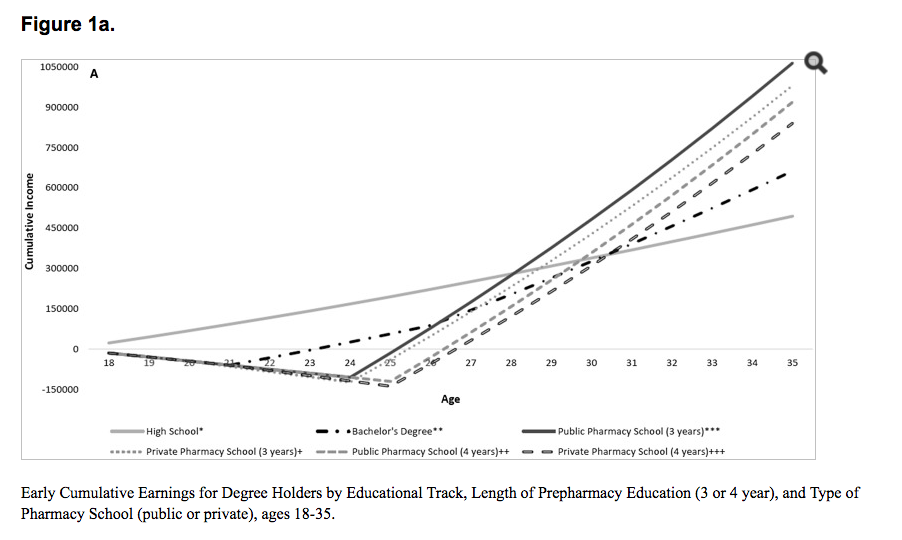

A: First, the baseline career of high school graduate had early career net earnings of $494,285 after 18 years of employment.

Earning a PharmD degree resulted in net early career earnings ranging from $716,345 – $1,064,840, depending on the number of years of pre-pharmacy education completed, type of school attended (public or private) and subsequent career path (community, hospital/no residency, hospital/PGY1, or hospital/PGY2)

No surprises here: The greatest net cumulative early career earnings were observed for public school w/3 years pre-pharmacy coursework + career in community pharmacy. Likewise, the lowest earnings went to the student who went to a private school + 4 years of pre-pharmacy coursework + career in hospital after PGY1 + PGY2. (Yikes! That was kinda me! Minus the PGY2 part)

- Perhaps most interesting was seeing the break-even age by which your early net career earnings would finally catch up with high school students and college graduates.

- You find that the fastest career track (Retail pharmacist w/ no residency + 3 years of pre-pharmacy training + public pharmacy school) caught up with biology and chemistry degree holders at age 27, while they caught up with high school graduates at age 29.

- The slowest/most expensive track (4 years pre-pharmacy + Private school + PGY2) didn’t catch up to high school graduates until age 33 and chemistry degree holders until age 33.

Q: Interesting! Makes sense. More school = More debt = longer time to catch up financially with people who piled on less debt. So what do you get from all this information?

A: I think it’s pretty interesting that depending on your career path as a pharmacy, you may not actually catch up with some of your peers who avoided more school until your early 30’s. I knew my Facebook feed had some truth to it; everyone else’s life is better than mine!

Looking at the two studies does, in my mind, lend some credence, to the original supposition that a technician who invests in their retirement early (with the benefit of compounding interest) can end up with a higher net worth than a pharmacist. Although, this of course, may not be the whole picture when we look at things like quality of life and cash flow throughout the person’s entire working career.

While net income may take a while to reach college grads and other career paths, it’s important to make sure that you don’t make decisions that will hamper your ability to save for the future. Buying large lifestyle items, or things that don’t appreciate may cause drag on your ability to create the net worth that you envision for yourself. Financially, you may feel like you’re behind, and in truth, you may be when compared to age-mates until your early thirties depending on your career path.

For me – I think this helps me to be patient and to maybe front-load things like debt repayment and making financial decisions that lead to a higher net-worth on the front end of my career in order to hasten the day when I can enjoy the fruits of my additional education.

Recent Comments